SEC Climate Rule: Scenario Analysis - Part 1

The United States Securities and Exchange Commission has published a proposed rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors. An important section (page 83) is entitled ‘Disclosure of Scenario Analysis, if Used’. It starts as follows,

We are proposing to require a registrant to describe the resilience of its business strategy in light of potential future changes in climate-related risks. A registrant also would be required to describe any analytical tools, such as scenario analysis, that the registrant uses to assess the impact of climate-related risks on its business and consolidated financial statements, or to support the resilience of its strategy and business model in light of foreseeable climate-related risks. Scenario analysis is a process for identifying and assessing a potential range of outcomes of future events under conditions of uncertainty

<my emphasis>

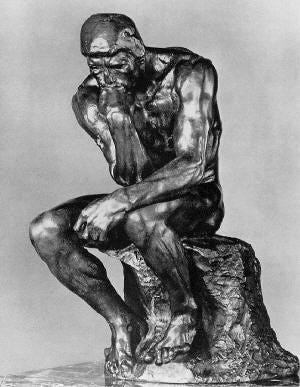

Scenario Analysis

Scenario analysis is important because we cannot assume that the future will be a linear, straight-line continuation of the present. There will be step changes or tipping points that create very different prospects. Those companies that recognize that such changes can happen, and that make their operations more resilient, are more likely to be successful in an uncertain future.

This series of posts, of which this is the first, is divided into the following sections:

A description and analysis of the SEC requirements.

‘Two Roads’ explains why scenario analysis is needed.

A description of scenario analysis techniques.

Some examples.

SEC Requirements

The SEC requirements and discussions to do with scenario analysis start on page 81 of the proposed rule. It starts as follows,

We are proposing to require a registrant to describe the resilience of its business strategy in light of potential future changes in climate-related risks.

Commentary

We start this series of posts by showing the requirements of the proposed rule, and then adding commentary and analysis. The wording of the rule is shown in bold/italic text. Commentary is shown in plain text.

Page 83

A registrant also would be required to describe any analytical tools, such as scenario analysis, that the registrant uses to assess the impact of climate-related risks on its business and consolidated financial statements, or to support the resilience of its strategy and business model in light of foreseeable climate-related risks.

The SEC companies to provide an explanation of the evaluation tools and techniques used (assuming that a scenario analysis has been carried out). The rule references the explanation of scenario analysis provided by the TCFD.

Scenario analysis is just one of the techniques that can be used. One other possibility — not explicitly referenced by the SEC — is ‘What-If’ Analysis. A

Page 83

Scenario analysis is a process for identifying and assessing a potential range of outcomes of future events under conditions of uncertainty . . . it is a tool used to consider how, under various possible future climate scenarios, climate-related risks may impact a registrant’s operations, business strategy, and consolidated financial statements . . .

The key phrase here is ‘potential range’. Scenario analysis looks at a variety of different outcomes, none of which are guaranteed to happen.

The SEC uses the word ‘uncertainty’, not ‘risk’. This is an important distinction. Risk analysis is often based on the use of models that assume that financial and operational systems do not undergo a fundamental change. Uncertainty analysis requires the team members (and the analysis has to be a team exercise) to “think the unthinkable”.

Reality

The SEC rule is lengthy (490 pages) and can be difficult to follow. For example, the above sentence starting, “A registrant also . . .” is at the 28th grade reading level. It is important never to forget that these are real world issues. Communication is critical. Just this week, for example, many parts of Europe are experiencing unprecedented temperatures. The SEC rule matters.

We continue this discussion to do with the scenario analysis requirements of the SEC rule in future posts.